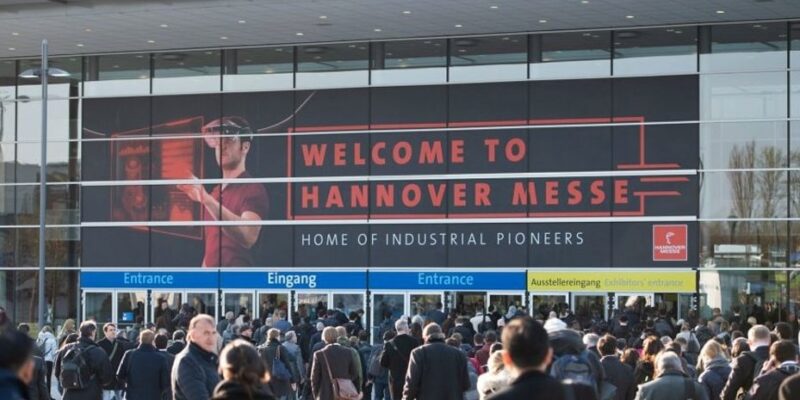

The information technology companies that used to present themselves at Cebit are now gathering in droves at the Hannover Messe Industrie (HMI) and showing that IT is fundamentally preparing to change all economic processes.

When the end of the Cebit was announced last year, it was only the foreseeable end of long-term negative development. However, this is not because IT is now meaningless; on the contrary, it has penetrated so profoundly into manufacturing, logistics, and other industrial value-added processes that it simply no longer makes sense to deal with the topic in the form of a separate major event.

A structure is indicated for the future in which special topics such as embedded, security, high-performance computing, data centre and cloud technology are dealt with in smaller, focused events. At the same time, the HMI shows how these technologies work when they develop at different points in the operational landscape.

In this respect, this year’s HMI was less about sensations and more about factual information about what is already working and where there are still problems. For this purpose, there were lecture centres on various topics equipped with very high-calibre speakers at multiple points. One of the most important here was undoubtedly the 5G Arena in Hall 16. There the current implementation status of 5G, especially in the industrial environment, and the obstacles that still stand in the way of this were discussed.

At the 5G Arena, numerous companies showed prototypes, models, and accurate production machines that work according to Industry 4.0 methods and are networked. In the latter case, 5G is said to play an important role, especially in Germany, in the form of so-called campus networks. For example, the prototypes are running in an Osram factory in Schwabmünchen, implemented by Telekom. By profiling themselves as operators of such infrastructures, which will usually run as a slice in public 5G networks, the telecommunications providers are trying to compensate for potential loss of earnings. Slicing means that – similar to a VPN– a completely separate “slice” of a company, for example, is defined in a public 5G network. Only the company has access to this slice.

The providers may lose earnings because the industry is allowed to have completely separate infrastructures. For this purpose, there is already available spectrum, at least in Germany, in the frequency band between 3.7 and 3.8 GHz, which has been withdrawn from the public networks.

This means that others may also have opportunities in this market: Sander Rotmensen, System Manager of Industrial Wireless Communication at Siemens, emphatically advocated an utterly separate operation of the industrial 5G infrastructures. Within its area in the 5G arena, Nokia showed a combination of Dell EMC Edge system and 5G antenna, which is already running in the Nokia factory in Oulu as a prototype for the automation of the production process and will soon be offered to customers.

However, the industrial 5G implementation will probably only take off when 3GPP Release 15 is approved in summer 2019. This version only offers the delays in the microsecond range, which are required for the real-time control of processes. With Release 16, which is expected for summer 2020, the final details for industrial use will have been primarily implemented. Release 17 is still in the requirements definition phase.

Especially for scenarios in which users want to remain open as to whether they choose this or that form of networking, Huawei has come up with a kind of access point with a previously hardly realized variety of technologies, which can also be attached very quickly. In addition to 5G, the device supports various other wired and wireless transmission technologies for short-range, which can work in parallel. It is doubtful whether the attempts to alleviate the security concerns of European users with an open code policy will be fruitful: the Huawei booth was relatively sparsely populated despite an overcrowded PK.

Two other major IT topics dominated the trade fair: the use of AI and machine learning and edge computing in many variants.

How strongly new ideas, especially for the IoT/Industry 4.0 area, are based on software technologies that are finally sufficiently powerful for knowledge processing could be seen in Hall 13, where the Young Tech Enterprises Startup Hub was located. A few examples: Gerotor showed an intelligent solution for storing and then feeding excess energy into ongoing processes (recovery) as part of Industry 4.0 strategies. The BMBF (Federal Ministry of Education and Research), the Fraunhofer Institute, Bayern Innovativ and Fences are also involved. With the Smart Unifier, amorph. Pro offers a universal linking solution for everything that needs to communicate within a factory.

Cybus Connectware performs a similar function. With Streamsheets, Cedalo has developed a solution with which one can communicate with machines via conventional tables without having to program. At the same time, the software optimizes processes through self-learning business heuristics and predicts or detects critical process conditions in real-time. The solution fits almost all IoT platforms due to its large variety of interfaces. The solution combines intelligent production data management with gateway and edge computing capabilities.

This brings Edge to the fore. Here, almost every hardware supplier had a wide variety of devices to offer – whether Dell EMC, Siemens, HPE, Huawei, Cisco, or whatever their names. In addition, there are special activities in the German middle class. One example of this is the rapidly growing QSC subsidiary Q-loud. She advises and implements tailor-made and 5G-ready IoT hubs that are no larger than a modem and offer a wide range of communication options. Hyperscaler clouds and the SAP and IBM clouds can also be connected via REST interfaces.

The Friedhelm Loh Group presented its start-up German Edge Cloud. Together with the acquisition of Innovo, it is the spearhead of the lively group of companies in the Edge Computing and Industry 4.0 market segment. For the customers, who will mainly come from the manufacturing German medium-sized companies, German Edge Cloud should design Industry 4.0 solutions and implement software and, if necessary, operate the software, which runs at Innovo or in the production-related Edge Cloud. For this purpose, around 18 data centres to be performed by Innovo will be built across Germany over the next few years.

An important building block in this concept is the cabinet specialist Rittal, which could contribute its contacts to the German industry and its hardware and cabinets and IT containers to the business. You will probably hear ideas like this more often shortly. The medium-sized manufacturing companies in this country are unwilling to let sovereignty over their process knowledge and their data quickly pass into the hands of others. After all, according to a current survey by Bitkom, presented during the HMI, 29 per cent of the 555 German industrial companies surveyed believe that Germany will be the world leader in Industry 4.0 by 2030. The USA came in first with 38 per cent. Only eight per cent opted for China. Whether that is wishful thinking remains to be seen.

Comments